Landing Transactions on Solana

Landing Transactions on SolanaIn the Solana ecosystem, timing isn’t just a tactic — it’s the whole damn strategy. Whether you’re running a scalping bot, deploying arbitrage between pools, or copytrading a top wallet’s next move, the gap between sending and landing a transaction is where profits are made… or lost.

And unlike slower chains where your trade might take minutes to finalize (or worse, hang indefinitely), Solana moves like a high-frequency scalpel — cutthroat fast and ruthlessly competitive. But speed alone isn’t enough. If your transaction never lands, it may as well have never existed.

That’s why mastering the mechanics of “landing” — getting your transaction not just sent but confirmed, finalized, and locked into Solana’s ledger — is critical for anyone playing at the edge of real-time trading.

In Solana-speak, to “land” a transaction means it’s been successfully processed and finalized on-chain. Not just broadcast. Not sitting in a queue. Actually written into the blockchain’s state history — irrevocable, done, dusted.

Think of it as the difference between sending a missile and hitting the target. In high-speed DeFi, you don’t get points for intention — only for impact.

Landing a transaction involves multiple steps: creation, submission, processing by validators, ordering via Proof of History, and finalization through network consensus. Each layer is a filter. Fail at any point, and your transaction could vanish into the void, dropped, overwritten, or timed out.

If you’re here, chances are you’re one of the following:

This guide will walk you through how Solana handles transaction flow — not just conceptually, but tactically — so you can stop guessing and start optimizing.

At its core, “landing” means full transaction finality — your bundle of instructions was accepted, executed, and baked into a confirmed block. All signatures verified, all instructions passed, and the network reached consensus that your operation is legitimate and immutable.

In Solana’s parallelized, high-throughput environment, not all sent transactions land. Some are dropped. Some are rejected due to failed instructions, expired blockhashes, or insufficient fees. Landing is the gold standard — and it’s what your strategy ultimately depends on.

In a fast-moving market, timing is alpha.

Solana’s architecture offers blazing speed, but to harness it, you need more than just transaction creation — you need successful confirmation. That means understanding the pipeline from wallet to finality and optimizing every layer along the way.

Let’s talk pipelines.

Ethereum relies on a public mempool, where all unconfirmed transactions wait to be picked up by miners. It’s like a crowded queue outside a nightclub — first-come, first-served (unless you tip with gas).

Solana bypasses the traditional mempool by forwarding transactions directly to the next expected block leader via Gulf Stream, then propagates confirmed blocks using Turbine for rapid finality across the network.Source: Helius Blog – “How to Land Transactions on Solana”

Solana? No mempool. It uses a protocol called Gulf Stream, which forwards transactions directly to the next expected block leader before they’re even up. It’s preemptive, surgical, and designed for minimal latency. That gives Solana a tactical edge — but also introduces new failure modes if your infra isn’t optimized.

In other words, you don’t just throw your transaction into the ether and hope. You strategize, you aim, and you land.

If you think submitting a transaction is a single act, think again. In Solana, it’s a five-stage relay race — and your transaction only lands if it clears every hurdle at speed.

Before anything hits the chain, it starts in your code — or your copytrading dashboard.

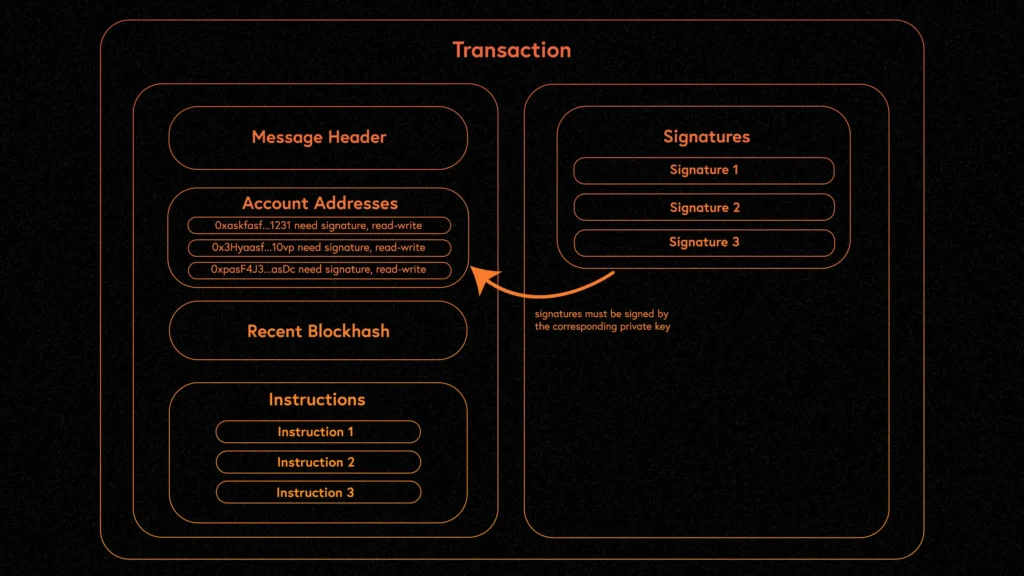

At this stage, a transaction is a bundle of:

Solana transaction is composed of multiple structured elements: header, instructions, signer accounts, a recent blockhash, and signatures. Every field must be valid and fresh to avoid rejection.

Here’s the kicker: most bot-based systems (and platforms like dEdge) construct transactions on-the-fly, pulling real-time prices, adjusting fees, estimating slippage — and doing it all in milliseconds. Every variable matters, and mistakes here can cost you the whole trade.

You’ve built the transaction. Now you need a gateway into the network.

Enter: RPC nodes (Remote Procedure Call endpoints). They’re like postal services for Solana, packaging your transaction and delivering it to the validator network.

But not all RPCs are created equal.

Landing is a race. Congestion and latency at this step can make or break it.

This is where Solana gets clever.

Unlike Ethereum, which stacks transactions in a public mempool like pizza orders on a busy Friday night, Solana’s Gulf Stream protocol forwards your transaction directly to the next expected block leader.

Think of it as pre-loading the gun for the shooter.

Why it matters:

If you’re using bots, copytrading systems, or anything latency-sensitive, Gulf Stream is your silent edge — if you know how to play it.

Now we’re inside the validator’s guts.

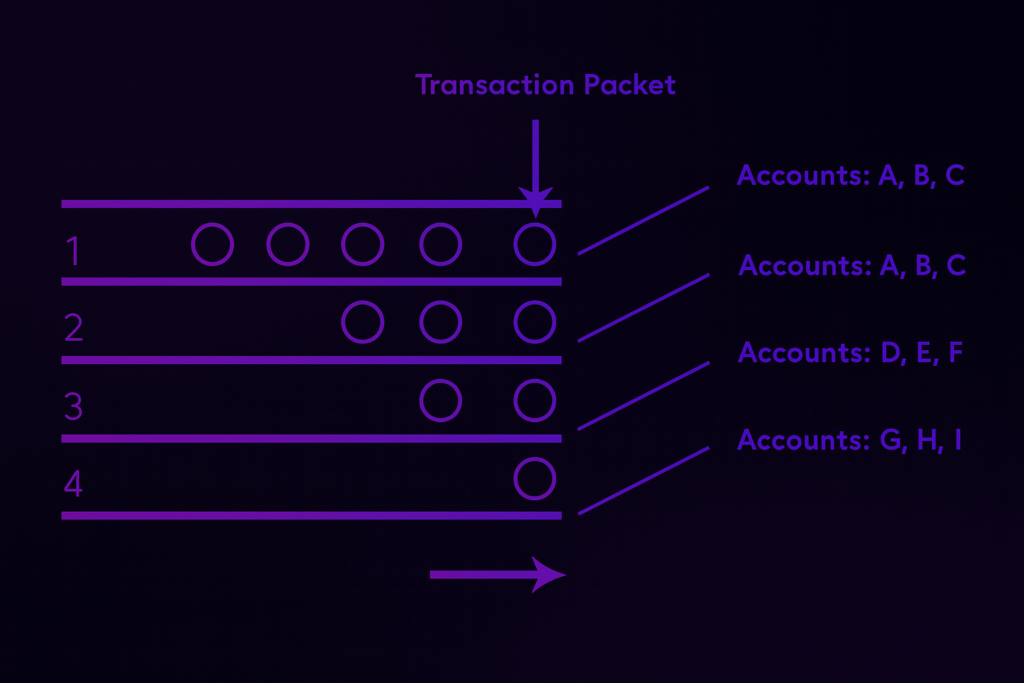

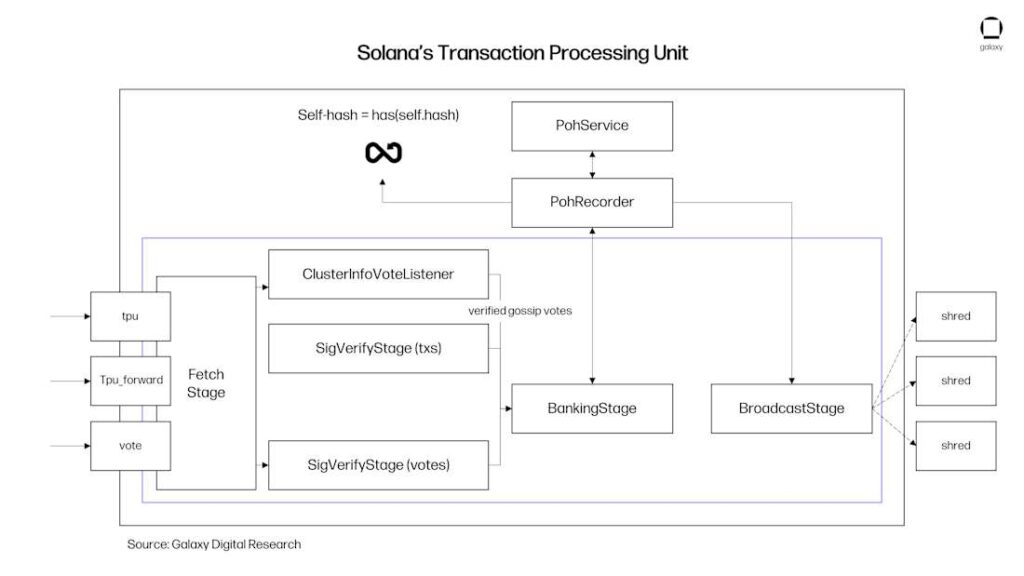

Solana uses a Transaction Processing Unit (TPU) to chew through transactions in a four-stage assembly line:

Each Solana validator uses a Transaction Processing Unit (TPU) with a multi-stage pipeline: it fetches transactions, verifies signatures, executes instructions in parallel, and broadcasts the result — enabling sub-second execution.

One key feature: atomicity. Every instruction in the transaction must succeed — or the whole thing fails. This is critical for composability, but it means one broken swap or mistyped instruction can nullify everything.

Landing isn’t real until the network agrees it’s real.

Solana’s Proof of History acts like a cryptographic metronome — ordering transactions without needing global consensus on time. It’s what lets Solana crank out blocks every 400ms.

Once a supermajority of validators confirms the block containing your transaction, it’s finalized.

That’s the moment your transaction is “landed.” Locked. Immutable. Done.

Even in a high-speed system, not every transaction sticks the landing. Here’s why:

Too many bots. Too much MEV. Too little bandwidth.

When traffic spikes, leaders may drop connections or skip transactions to maintain performance. This is where inferior infra gets exposed — and optimized platforms shine.

Solana is cheap — but not free.

Validators will prioritize transactions with higher compute or priority fees. If you’re underbidding (or setting “normal” priority during a network storm), don’t be surprised when your trade gets iced.

Pro tip: Use APIs that let you set priority dynamically — think “veryHigh” when time = money.

Every transaction includes a reference to a recent blockhash. If it’s too old (typically ~2 minutes), validators won’t even try to process it.

Bots and auto-resubmission logic must refresh blockhashes frequently or risk instant rejection.

This one stings: Solana transactions are atomic.

For devs and bot builders, this means meticulous instruction validation and fallback routing is a must — or you’re throwing trades into the void.

Solana isn’t just another chain — it’s a high-frequency trading engine masquerading as a blockchain.

Compared to older chains, it’s like stepping off a cargo ship and into a fighter jet. You’re no longer waiting for blocks to maybe include your trade — you’re dancing in real time.

For copytrading platforms and strategy replicators, speed = survival.

And because of Solana’s deterministic finality, once you’re in, you’re in. No “pending” purgatory. No reorg risk. Just pure execution.

In volatile DeFi markets, the edge isn’t just in what you trade — it’s in how fast you can react.

Solana gives you the infrastructure to:

But only if your transactions land.

Landing transactions on Solana isn’t just a technical detail — it’s a trader’s edge, an infra play, and a strategy multiplier.

It’s the difference between watching a move happen and being the one who makes it.

Let’s recap:

For copytraders, builders, and real-time strategists, every missed transaction is missed alpha.

So don’t just submit trades. Land them.

Because your edge isn’t just in the trade —

It’s in the transmission.